It’s a well known fact that many seniors like to travel when they retire. It makes perfect sense if you think about it. After all, you have the power to choose where it is you want to be, your children and grandchildren are busy with their own lives, and you have a lot of leisurely time on your hands. Traveling is the best way to spend your golden years.

A lot of boomers, seniors and retirees choose to go on cruise ships. It’s convenient, it’s not very expensive, you have everything you need on board, and you can have a lot of fun. Entertainment is not an issue. But have you ever thought of breaking out the mold a bit by doing something more exciting? A trip to India is definitely something everyone should do at least once in their lives. It’s a spiritually rich country that has a lot to offer. Check out the 5 best destinations for retirees below, and get ready to pack a bag or two! Goa

In Old Goa, you will find the beautiful Basilica of Bom Jesus. UNESCO has declared it a World Heritage Site. The baroque architecture is just breathtaking. The destination has won a Traveler’s Choice Award in 2017, and it wasn’t for nothing. The sandy beaches will provide a quiet and relaxing place where you can enjoy some curry and drink some Kingfisher beer. You will come back with beautiful pictures and great memories. At Christmastime, the East and the West come together culturally, and you will be enjoying a wonderful religious ceremony.

Jaipur

In Old Goa, you will find the beautiful Basilica of Bom Jesus. UNESCO has declared it a World Heritage Site. The baroque architecture is just breathtaking. The destination has won a Traveler’s Choice Award in 2017, and it wasn’t for nothing. The sandy beaches will provide a quiet and relaxing place where you can enjoy some curry and drink some Kingfisher beer. You will come back with beautiful pictures and great memories. At Christmastime, the East and the West come together culturally, and you will be enjoying a wonderful religious ceremony.

Agra

You can’t say you went to India without seeing the Taj Mahal. The whole trip is incomplete without it. It’s the biggest token of love known by man. The Taj Mahal was built by the Mughal Emperor Shah Jahan in loving memory of his favorite wife, Mumtaz Mahal. The beauty and the architecture of the palace are world famous, which is why it is considered one of the eight wonders of the world. In Agra, there are two other World Heritage Sites declared by UNESCO, the Fatehpur Sikri, and the sandstone Red Fort.

Rishikesh

If you want to have beautiful spiritual experiences, then Rishikesh is the place to go. It is located at the base of the Himalayas, and it is a very important cultural and spiritual location for the Hindus there. Sacred rivers are flowing through the mountains, and the yoga spots look as if someone cut them from a magazine. The Beatles went there in 1968 to get in touch with their Eastern spiritual side and wrote several songs at a local ashram.

Bengaluru

Bengaluru is also known as “The Silicon Valley of India.” It is a geek’s paradise but is also know for its cultural riches. You can visit plenty of gardens, museums, palaces, and temples. The natural features of the city are absolutely stunning. You can go to Cubbon Park and Ulsoor Lake of Bangalore. You will love the boating facilities. Also, Bengaluru has a lot to offer regarding music. It is one of India’s classical music and dance centers. There a lot of concerts you will surely enjoy.

Getting Your Travel Visa for India

Getting to India is not very hard, especially if you travel by plane, and getting a visa is easy as pie. You can apply for an India e-visa online in just a few minutes. You don’t have to spend hours sitting in line at the consulate, and you will have your visa in maximum three days. Just in case you cannot handle the bureaucracy, you will get assistance every step of the way. The service is there to help you 24/7. There is little you have to do. In this regard, the hardest part will be packing your bags!

Keep in mind that these 5 locations represent only a small portion of what India has to offer, but they are all worth visiting and are very popular with retirees. You’ll go back home with wonderful memories and stories to tell your grandchildren. You will also feel enriched in every possible way. Namaste!

Retired Brains is not a travel service, and does not offer direct travel support assistance. The purpose of this blog article is to provide helpful information on some popular locations in India should you choose to travel there. As with any international travel you undertake, we recommend researching local customs and other demographic data to ensure you are prepared for cultural immersion. You may also want to contact a travelers bureau in your area to find out about any international circumstances or situations, including safety concerns, that might affect your decision to travel abroad.

0 Comments

Advantages to Pension Fund Investing

A retirement pension fund is the typical method of retirement savings and investing. For this reason, it’s often viewed as the safer investment bet when you’re planning for your retirement. Pensions rarely lose money that is invested into them, although they may not grow dramatically, either. There are also extensive tax benefits involved when putting your retirement investing into a pension fund. If you choose to use a company pension program, the money you contribute towards your retirement will be pre-tax.

While this reduces your total taxable income in the present, you will be forced to pay taxes on your retirement savings later in life when you go to withdraw. On the other hand, if you invest in a private pension fund, the likelihood that you’ll invest from your net-income (or post-tax income) is high, and your withdrawals during retirement will be completely tax free. Regardless of which fund you choose, having tax benefits on the front or back end of your investing is a definitive benefit of pension fund investing.

Another advantage to pension funds is that, in many cases, an employer will contribute an equal amount up to a certain percentage of your pay towards your pension fund. These match programs can drastically increase your overall retirement savings, and if you contribute wisely at the beginning of your career, you’ll be able to earn interest on a greater amount of funds invested for a longer period. These extended earnings have the potential to set you up nicely in your retirement. Disadvantages to Pension Fund Investing

While pension funds do offer a secure way to invest and save for retirement, they can also be disadvantageous. The most notable disadvantage of pension funds is the lack of flexibility in when you can access your money. In most cases, you won’t be permitted to withdraw funds from your pension until you’re 55, and even then you’re subject to taxation. For those who are interested in possibly retiring early or taking an untraditional retirement in which they start a second career, go back to university, or choose to live internationally, these pension fund withdrawal limitations may be restricting.

Additionally, the performance of pension funds depends entirely on the investment of your assets. If you invest poorly, or in too conservative a way, your funds may not grow much, if at all. This means that your pension fund is essentially a glorified savings account with employer contribution and better than average interest. Still, for many, this isn’t enough for them to live the way they want to during their retirement. Advantages to Property Investing

When you choose to invest your retirement funds in property rather than a traditional pension fund, you have significantly more flexibility when managing your investments. For example, you can monitor the real estate market to select the perfect property investment, and from there you can choose to either live there full time, use the property as a vacation space, or make even more money on your investment by setting it up as a rental property. If you ever want to sell your property, it is a physical asset and you have the capability to do so. Whether you’ve decided you’d like to use your funds earlier than planned, or you are ready to invest them in another market, selling property is much easier than cashing out your pension fund early.

Additionally, the property market has more flexibility with the levels it can fluctuate. You can purchase a property in a buyer’s market and sell for significantly more in a seller’s market, often making much more on your investment than you would have made had you put the same funds in a traditional pension fund. Disadvantages to Property Investing

Admittedly, property investing is much less stable than pension funds. Property markets tend to fluctuate with some regularity and little to no warning. There are also more maintenance expenses and up front taxes involved with a property investment. These upfront expenses can often be a deterrent to those looking for investment opportunities, and few view an expensive property as a viable means to save for retirement as a result. Despite the inherent volatility of property investing, it can often be an excellent vehicle for those looking to invest or to access the return on their investments sooner than a pension fund would allow.

Should You Consider Overseas Property?

The answer to that is a glowing “yes, absolutely”. If you are going to go with property investing in spite of the inherent risk you should consider doing so abroad. Some countries like Romania can offer staggering returns of 7, 8 or even 9% annually. You could potentially diversify your overseas property investments over 4-5 developing countries (in which homes are very cheap in, with high annual rental yield) and minimize the risk, and be much better off upon pension.

You don’t have to worry about dealing with the nitty gritty. There are professionals in the field that specialize in dealing with foreigners. Lawyers, property agents, and international money transfer companies deal with tens of thousands of clients just like yourself.

What is the Bottom Line?

To each his or her own. Both options are valid, it just depends on how risk averse you are, and of course, your financial status. No matter whether you choose to invest in property or a pension fund, be sure to consult a qualified adviser who can help you make the wisest choice based on every factor affecting your decision.

Retired Brains does not offer direct financial investment advice, nor do we affiliate ourselves with any particular financial advisers or firms in the United States or worldwide. Rather, the sole purpose of this article is to present educational, helpful information that can help you decide what kind of investing strategy is right for you in your retirement. If you are interested in learning more about property or pension fund investing, we recommend seeking out a reputable adviser or firm in your area for assistance. What is Bridge?

The Benefits of Playing BridgeHere at Retired Brains, we love helping you find activities that add value to your life. This includes leisurely pursuits that keep you socially active and mentally sharp. In this spirit, we are going to discuss the benefits of playing bridge, in order to help you decide if bridge might be a good activity to partake in. Some of the many benefits of playing bridge include:

Now, it is no secret that playing bridge is akin to mental gymnastics. In this regard, stimulating your brain regularly is believed to be an important component in warding off diseases including Alzheimer’s and Dementia. However, boosting immunity to ward off illness was not necessarily considered to be one of the benefits of playing bridge until the early 2000’s, when Professor Marian Diamond (no pun intended!) undertook an experiment at the University of California Berkeley with 12 ladies in their 70’s and 80’s. Professor Diamond began by taking a blood sample from each lady, and then had the group play bridge for 90 minutes. After that, she took blood samples again. She found that 8 of the 12 ladies had increased levels of T Cells in their bodies as a result of play. T Cells, of course, are used by the human body to fight infection. Professor Diamond’s hypothesis, that using the dorsolateral cortex of the brain by playing bridge can boost the immune system, was proven correct. Isn’t that neat? What is more, advances in modern technology mean you do not even need to leave the comfort of your home to enjoy the benefits of playing bridge! Why Play Online Bridge? Bridge is a natural game of choice for retirees, because retirement allows you to have more time on your hands to enjoy leisurely pursuits. For example, duplicate bridge typically allows for 7-8 minutes per hand, with anywhere from 22-26 hands per session. This means one session can take almost 3.5 hours to complete! Some people enjoy leaving the house to play bridge in community clubs.

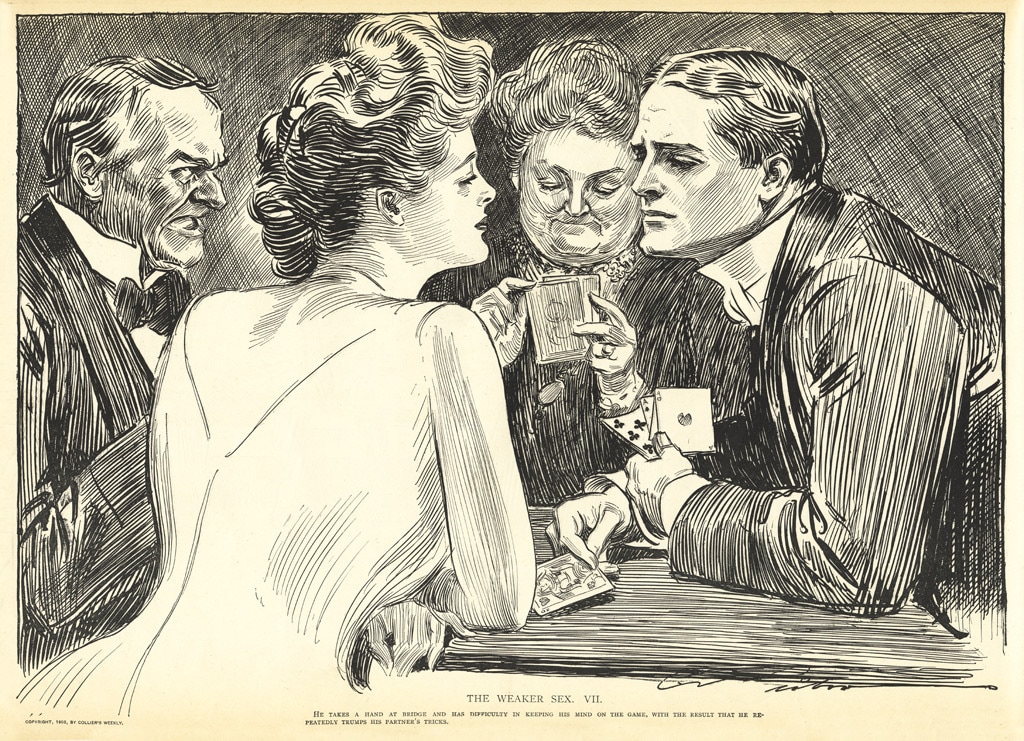

If you choose to play online bridge, you can rest assured that your mental sharpness will still benefit from the strategy, deduction, concentration and visualization required. Furthermore, many online bridge sites have a ‘chat’ function, which means you are able to communicate with your partner and other players in live-time. This allows you to experience meaningful social interactions, and even make some new friends in the process. Another benefit, should you choose to play online bridge, is that many platforms are open for play 24 hours a day, 7 days a week, 365 days a year. So unlike a community hall with set hours of play, if you choose to play online bridge, you can do so whenever you wish! Playing Online with the Funbridge Download Retired Brains has found a fun, interactive and easy-to-use online bridge platform called Funbridge. Funbridge is an established bridge site that connects bridge players from all over the world. Funbridge has individual games, as well as many different kinds of tournaments you can participate in. To use Funbridge, you need to sign up for an account and download their free, easy-to-use application program for your desktop computer, laptop or mobile device. Once you sign up, you will automatically receive 100 free ‘deals’. You can use these free deals to help you decide if playing online bridge is the right fit for you. If you decide that it indeed is, you can purchase monthly packages, including unlimited play. Please visit the Funbridge website to learn more, and to see if their platform is right for you. No matter what leisurely pursuits you choose to partake in, we hope this article helps you find stimulating, meaningful activities that are right for you...and that add tremendous value to your retirement years! *The purpose of this article is to provide helpful information that allows you to make an informed decision as to whether or not playing online bridge is right for you. As with any online or in-person gaming platform, you should always do your research to make sure you understand the terms, conditions, costs and any other stipulations associated with membership. If you have any questions about the Funbridge platform specifically, we recommend contacting them directly. Image Credit: The image of British nobility playing bridge is used with the permission of Creative Commons licensing, and is courtesy of the MCAD Library. The image was originally created by Charles Dana Gibson in 1903 for Collier’s Weekly.

No matter your reasons for wanting to find temporary and part time jobs, it is important to know that you have more options than ever before when it comes to landing the perfect retirement job. Why Retired Workers are in DemandMore and more are opting to turn to workers with a more mature, loyal outlook on employment. Some of the reasons employers are gravitating toward retired workers to fill temporary and part time job positions include:

This shift in attitude is plainly seen in the steady increase of retired workers in the job force. According to the United States Bureau of Labor Statistics (USBLS), retired workers currently comprise over 8% of the workforce. This number is expected to increase to 11% by 2022. Additionally, recent data from the USBLS shows that as life expectancy continues to increase, so does the amount of older retired workers in the workforce. Specifically, since 1985, the number of retired workers over the age of 75 has more than doubled from 3.6% to 8% currently. Why Temporary and Part Time Retirement Jobs?Although some retirees decide to continue working a full time career into their retirement years, we feel this is a decision best left to your individual needs and situation. There is something to be said for allowing yourself to enjoy your retirement as you see fit. The responsibility and, many times, stress accompanying full time career occupations can become more difficult to successfully manage as we age. However, the job can accentuate and compliment your leisure time, and not take away from them in any regard. Many temporary and part time retirement jobs allow you the freedom to make your own schedule, as well as the other benefits of employment we have discussed already. What is more, many temporary and part time retirement jobs allow you to help other people in various capacities, which is always a wonderfully effective way to be involved and feel great doing it! You might be asking yourself how you can go about finding jobs that allow you to choose your own schedule, and provide you the opportunity to embark on employment that compliments your retirement living? Well, let’s discuss that right now. Using Shiftgig to Find Part Time or Temporary Retired Jobs Shiftgig is in 12 cities located across the United States currently Shiftgig is in 12 cities located across the United States currently Retired Brains has found a company that takes a uniquely effective approach to helping retirees find part time or temporary retirement jobs. Since 2012, Shiftgig has helped match businesses in the hospitality and service industries (so people-based businesses) with people seeking flexible, fun and fulfilling part time or temporary jobs. Shiftgig helps make finding part time or temporary retired jobs easy. First, you fill out an application on their website. From there, a member of the Shiftgig team will reach out to you via email to set up an in person interview. If hired, you'll use their mobile app to browse available work and other specifics relating to the job you choose.  Shiftgig is currently located in 12 cities around the country: Atlanta, Chicago, Dallas, Houston, New York, Memphis, Miami, Milwaukee, Nashville, New Orleans, Phoenix and Tampa. However, their popularity means you should be on the lookout for them to put roots in your city soon. No matter where you look for and find part time or temporary retired jobs in your area, we hope that you find it. What is more, we hope it increases your quality of life by adding value to your retired years, while having some fun in the process! *Retired Brains is not an employment service, and does not offer job counseling or personalized employment advice. We simply strive to help boomers, seniors and retirees of all ages find resources that help add value to their lives. Retired Brains is not affiliated with Shiftgig, but find their platform to be unique and potentially helpful when looking for part time or temporary retirement job opportunities. Therefore, we always recommend doing your homework to make sure the job resources you choose are a good fit for your wants, needs, situation and of course, technological abilities.

Worry not! You don’t have to be reading War and Peace every day to get your brain the exercise it needs to stay sharp. Try these 10 fun activities and hobbies instead:

How will you embrace the freedom of retirement? Start with finding fun, engaging hobbies that vitalize your brain and help you stay active!

As grandparents, we want to help our grandkids make all the right decisions in life. You may sometimes feel like you are powerless to do so for a variety of reasons, but there are still positive effects that you can have on these younger relations. Stay Close, Regardless of Distance  You might feel like you are too far away from your grandkids, either with a large location gap or with the distance between your generations. These shouldn’t be a factor when it comes to making a connection though, as you can still relate to your grandkids on a personal level. At the end of the day, you are their family and they can turn to you when they need to. As a grandparent, you can bridge the gap between parents and their kids, as they can see their parents as stricter and more reactive to these kinds of things. As someone slightly removed from the situation, you can provide balance and show kids that their parents have a side too. There’s nothing better than a listening ear after an argument, you can even offer them a place to stay to cool off. Create a Non-Judgmental RelationshipIf you cultivate a good relationship with your grandchild, then you will naturally be someone that they can turn to. Because you’re not the authority figure that they are around most often, in most cases, you can shed light on situations and be a person that they can turn to. When it comes to a drug addiction, having that support there can prevent a lifetime of problems. Provide Information and Advice  It’s not just hard drugs that you can help your grandkids with, you can provide information about stimulant abuse and the effect this can have on their health. Stimulant addiction treatment is becoming more popular because of grandparents, parents and even kids themselves realizing their dependence on things like caffeine and alcohol. If you think they have a serious problem, then you can always pass over details of an addiction treatment center that they could look into. Identifying these kinds of problems is half the battle, especially if the grandchild is having a difficult time at home. They could be in serious need of time in an addiction treatment center but just not know who to reach out to. This is not the situation that you want them to be in, as it’s a slippery slope towards drug abuse. Step into Family Life When Needed It has been shown in numerous studies that those who have close relations that they can turn to will be statistically less likely to fall prey to abusing substances. Family counseling can even help to address the root of these problems and figure out why they are occurring in the first place. You can advise your children and in laws about any potential problems and give them advice that comes from an impartial place. They can spend so long attempting to police the behavior of their child that they may not realize their own failings. The main job of a grandparent is to listen, no matter what the scenario. If you create a safe space for your grandkids to discuss everything that they have going on. Don’t judge or make them feel like they don’t want to come back to you for more advice. In many cases, you don’t even need to give advice if it is unwanted, you can just provide an outlet for any frustrations and a place to talk. We’re facing an epidemic when it comes to battling drug addiction, anything you can do to help your grandkids is a positive step. Just be there for them and you’ll be ready to help when needed. Retired Brains does not offer drug rehabilitation programs, or substance abuse counseling. Rather, we strive to provide you with educative information that can add value to your life, as well as the lives of your loved ones. if you or a loved one is experiencing substance abuse issues, we recommend consulting a professional for help immediately.

With increases over the past several years in regulations protecting borrowers, reverse mortgages are being considered viable options for helping some people fill gaps in their retirement income. However, the question of, "Are reverse mortgages a good idea?", is solely dependent upon several factors. These factors relate directly to the individual or couple looking to enter into a reverse mortgage agreement.

If you are wondering are reverse mortgages a good idea, we welcome you to read this reverse mortgage information article and learn whether or not you may be a good candidate for one*. Reliable, unbiased information about reverse mortgages can be difficult to come by. If you are looking for trustworthy information about reverse mortgages, it is important to consult organizations that have no direct financial stake in whether or not you enter into a reverse mortgage agreement. Information About Reverse Mortgages

According to the Federal Housing Administration, approximately 30,000 people entered into a reverse mortgage in 2016. This number is down significantly from the peak of the reverse mortgage boom in 2009, which saw over 115,000 of these types of home loans processed. During the boom of 2009, the reverse mortgage market was deregulated, which ended up causing serious issues for many borrowers.

However, increased lender regulation has afforded better protection for borrowers. Even with more protection, you still should ask yourself “Are reverse mortgages a good idea for me?” based on your specific situation--instead of relying on existing industry safeguards, which might not apply to your situation anyway when push comes to shove. The following information about reverse mortgages can help you decide whether or not you are an ideal candidate for a reverse mortgage… Who is the Ideal Candidate for a Reverse Mortgage?

More Reverse Mortgage Information

Before applying for a federally insured reverse mortgage covered by the US. Department of Housing and Urban Development (HUD), you are required to meet with a counselor from an independent, government approved housing counseling agency. Your counselor will go over the loan’s cost, as well as any financial implications you should be aware of. This consultation can be incredibly helpful in deciding are reverse mortgages a good idea for your situation. You can visit HUD for a list of counselors, or call the agency at 1-800-569-4287 to learn more. Please note that counseling agencies usually charge for their services. However, their fees can be paid from the loan proceeds, and you cannot legally be turned away if you can’t afford the consultation fee.

Reverse Mortgage Alert: Find Reverse Mortgage Lenders

If you feel as though you would be an ideal candidate for a reverse mortgage, the next step is starting to shop around for the right lender. Retired Brains has found an excellent informational website called Reverse Mortgage Alert you can visit to assist with the shopping process. The Reverse Mortgage Alert website has some very useful information for first time borrowers that can help reduce the confusion and stress often associated with the reverse mortgage process. This includes compiling lender information, providing a reverse mortgage calculator, offering information on the pros and cons of reverse mortgages, and a very informative fact sheet to help empower you in your decision making process. Please visit Reverse Mortgage Alert to learn more.

*Retired Brains is not a reverse mortgage lender, and we do not provide direct or indirect advice on whether or not you should enter into a reverse mortgage agreement. Our sole purpose is to provide you with information that can help you decide if you would like to find out more about whether or not a reverse mortgage is right for you. Therefore, we cannot be held legally or financially liable for your personal decisions. If you have any questions about a current or potential reverse mortgage agreement, we urge you to contact a professional adviser who can help you find the answers you seek.

|

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed