|

No matter whether you’re a millionaire or living paycheck to paycheck, the best way to gain control over your finances is to create a budget to clear your debt hurdles. Unfortunately, when most people think of budgets, they usually picture money restriction, but budgeting allows you to focus your dollars, so you can cover every expense. The good news is a budget is easy to set up and maintain, even if you’re not good with numbers. All it takes is a few key pieces of information and a little time. Gather Your IncomeYour income is the easiest piece of information to add to your budget because it’s straight-forward. When gathering your income, include every source that brings money into your household. You’ll create a budget for the entire month, so add up all your income no matter when that money hits your bank account, and plug it into a spreadsheet. Write Down Your ExpensesThe meat of your budget lies in your expenses; to create a comprehensive one, you need to include every expense that requires your money. Make a line item and include the monthly dollar amount you pay for it. If you don’t have an exact amount, an educated estimate will do. Here are some expenses you might have in your budget:

One flexible expense you have control over is your credit card payment, especially if you have more than one. You already know once you run up credit card debt, it’s hard to get rid of, and that’s straining on your budget. But there are companies like Braidwood Capital who can help you consolidate your credit card debt with one loan and lower your interest rate. Once you focus on the expenses that you can eliminate or change, the more income you free up for other things. Don’t Forget the Sometimes BillsHow many times has a holiday snuck up to surprise you, and you haven’t saved a dime for it? What about when your car needs a new battery, and you have to charge it because you have no emergency savings? Instead of getting caught with a surprise expense, make these events line items in your budget. For example, estimate how much you spend on gifts in a typical year and divide that number by 12. Then, make a line item for gifts in your budget using your monthly estimate. That way, when a birthday or holiday comes around, you have money earmarked for that expense. Doing this for each anticipated expense, no matter how infrequent, prepares you ahead of time, and lessens the chance of increasing your credit card debt. Bring the Bottom Line to ZeroThe goal of your budget is for your bottom line to equal zero dollars. In other words, your income should match your expenses exactly. If you have any leftover income, add a line item for savings and transfer that money over to a separate account in another bank for safekeeping. If the difference between your income and your expenses is a negative number, you have two choices: increase your income or decrease your expenses. Start by trying to lower your expenses to see if you can balance your budget that way. If you can’t, you’ll either have to eliminate some luxury items or increase your income streams. Working Budgets Bring FreedomIt might sound restrictive to account for every dollar that enters your home, but the opposite is true. Whether or not you track your dollars with a budget, you're using your money somewhere.

It’s better to control where that money goes, so you can redirect it to more important areas in your life.

0 Comments

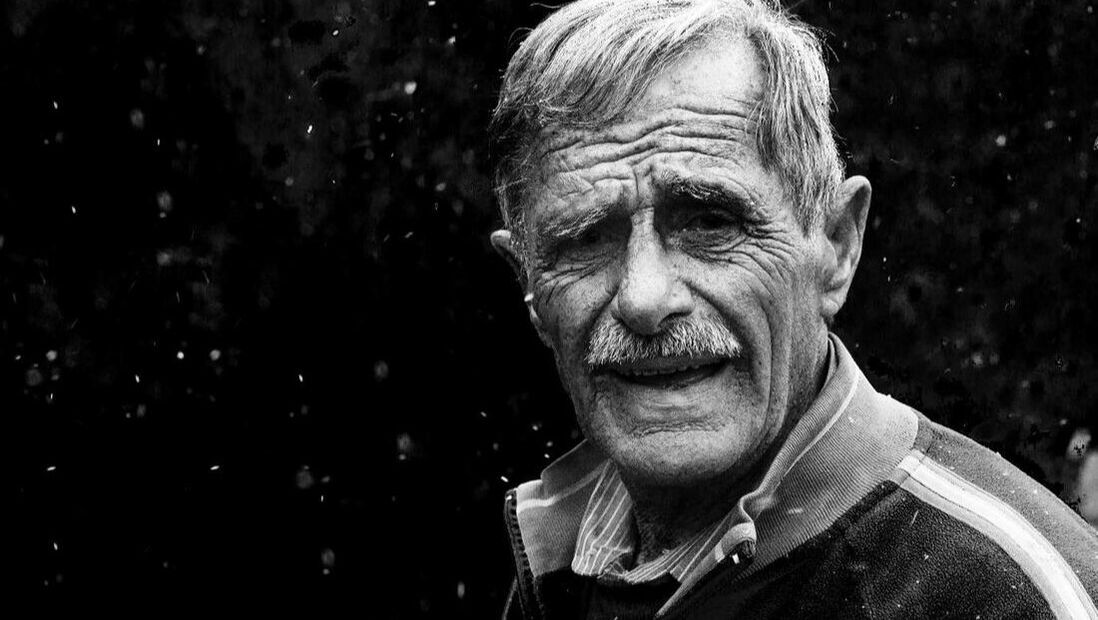

Aging is the most beautiful process of nature. It tells us the worth of life and the importance of living your life to the fullest while you can. Due to this reason, it is seen that people who spend their lives living their dreams and people who are not hung up on anything in life live a peaceful and contented post-retirement life. The way you have spent your life was entirely your choice, but now you are progressing towards old age and your post-retirement life. So, if you are wondering how you can make sure that you live a healthy and easy life after retirement, then this blog is just the thing that you need to read. Here are some ways that will help you in making your post-retirement life easy: Schedule Your Medical CheckupsIf you are retired, and you still don’t have any medical condition, you should consider yourself the luckiest person alive. However, it doesn’t mean that you don’t have to take your health seriously. No matter how physically sound you may look, but you still have to make sure that you get your medical checkups regularly. Embrace Relaxation and MeditationYou need to understand that you’ve worked all your life and now it’s time for you to relax and take some time out for yourself. Meditation and relaxation have a close link. Therefore, you need to make sure that you take some time out of your routine every day to meditate and relax your body. This way, you’ll feel a deeper connection with both nature and your body and soul. Understand Your Body RequirementsOne of the most important things that many people in old age tend to ignore is their body requirements that change with age. If you don’t know this already, then you must know that your body requires oxygen in a different amount than it used to at a younger age. The same is the case with other requirements. So, you can buy portable hyperbaric oxygen chambers to make sure that your body is getting all the oxygen requirements on time and at the ease of your home. Socialize As Much as You CanYou need to make sure that you are socializing with your circle. It really helps to fight dementia. Above all, it’ll keep you busy after retirement. This way, you’ll get to know more about your family and friends and be sure that they are doing okay. So, if you look at it, it is an opportunity to catch up with your friends and family. Limit Your Alcohol IntakeLastly, the most important thing is to limit your alcohol rate. You need to understand that your liver doesn’t have that regeneration capacity that you had in your youth. So, the only wise thing to do is to limit your alcohol intake so that you don’t have to face any health complications because of excessive alcohol consumption.

The hope is that you go through life without ever having to experience an emergency. Realistically, however, unforeseen circumstances pop up all the time. Though you may not be able to do much to avoid the issue, having a plan of action can make weathering the storm a lot easier. Unfortunately, most people fail to create a plan which is the biggest mistake you can make in the midst of a national pandemic. Adults over the age of 60 are considered to be the most at-risk of contracting the coronavirus. They’re also the most at risk of getting sick or injured, the most-targeted crime victims, and the most vulnerable in the event of a natural disaster. Should something go wrong in the middle of a pandemic, seniors in poor health face an uphill battle with a lot of questions that need answering. Seniors are the most isolated from their friends and family as they remain sheltered in place while some live in high-risk environments like nursing homes and senior living communities. It is for these reasons and more that an emergency preparedness plan needs to be developed. Continue reading for details on what your plan should include. A Network of SupportWho can you call on when trouble arises? Creating a personal network of people to support you during the pandemic and beyond is ideal. This group can include your adult children, your extended family, friends, and even healthcare workers like your home health aide. It should be a group of people that you can rely on to be there when you call. People that will check in on you regularly and spring into action if you need assistance. Important Health DocumentsIf your support network is going to be able to assist you in an emergency, they need to have access to certain information. Make sure that you have your birth certificate, social security card, living will, and your health information card (detailing any medications, health conditions, and emergency instructions). Medical Contact InformationThere are some important numbers you want to keep visible for yourself and your support group. Trying to scrounge around and figure this out in the middle of an emergency only adds to your stress. Therefore, you should create a list of medical providers/services to contact in the event of an emergency. At the top of the list, make sure you have the number to your primary care physician, dentist, and any other medical professional you’re currently seeing. You should also do some research to find out which hospitals and urgent care centers are available near you. If you were interested in going to Our Lady of Lourdes, for example, you’d want to find out what Lourdes ER wait times are, the hours of operation, and a contact number. Plan of ActionYou and your support group need to develop a plan of action in case of an emergency. You all need to be on the same page about what to do if you contract the coronavirus, fall and get injured, or develop some other medical problem. You should also have a plan for other emergencies like natural disasters.

Your plan of action needs to include several methods of contact (just in case phones aren’t operational), a chain of command, and a meeting place. You should also discuss what role each person has and share the location of the information you gathered from above. Make sure you’ve provided someone with the keys to your house and car so they can access your possessions if necessary. During times where the risk to the health and safety of older adults (and the rest of the population) is at its highest, emergency preparedness needs to be a top priority. You never know what could happen when you least expect it. Be it sickness, injury, natural disaster, or otherwise, having a solid plan backed by a strong personal network will ensure that you remain safe and get the help you need more efficiently. Many people dream of the day where they retire but when they actually get there, they aren’t ready. There are many things that you need to do in preparation for your retirement including organising your finances, finding something to keep you busy and making sure that your home is suitable for when you are less mobile. In this article, we are going to offer some tips to help you prepare your home for retirement. Easy to Clean FloorsOne of the things that is often overlooked by those who are preparing their home for retirement is the floors. When you are slightly older and less mobile, you will find it trickier to get down on the floor and clean it. For this reason, you will want to make sure that you have suitable flooring in place. For this, we recommend investing in some luxury vinyl click flooring, or LVT flooring. This kind of floor is perfect for cleaning quickly and without straining yourself too much. Accessible BathroomsWhen you hear someone talk about preparing their home for retirement, you’ll probably have heard them mention accessible bathrooms. This not only refers to having a bathroom in a location that is accessible but also having bathroom furniture that is easy to use. While you might not struggle to get into the bathtub just yet, it is possible that this can be trickier over time. This is why you should consider investing in some new bathroom furniture that will futureproof your home. Focus on The Big ThingsDepending on how much you are planning on saving for when you are retired, your financial position could change. Some people have more money in their retirement while others struggle to get by on savings or a pension. For this reason, you should make sure to prepare the big items in your home before you get to this stage. For example, you might want to re-insulate your home, replace the heaters or even have solar panels installed. Once you get these out of the way, you’ll have less to worry about in the future. Keeping Yourself BusyThe final tip that we have for those who want to prepare their home for retirement is to make sure that you have a space to keep yourself busy. Do you have a hobby such as crafts, baking or even exercise? Why not create a space in your home to cater to this for when you retire? This is your time to do what you want so make sure that your home is ready to help you enjoy yourself. Get Started NowIt is never too early to prepare your home for retirement so why not get started now? You’ll need to think through everything carefully and make sure that you have a plan in place. Try to focus on the big things and consider your enjoyment as well as your safety and health.

People in their senior years are often in a situation where they have completely retired from work, which means that they receive a limited income each month. This can make things difficult if unexpected bills come in or money is needed for other reasons. For those who do not have money saved for emergencies, this can create a very difficult situation. This does not mean that there are no financial solutions for seniors on a limited income. In fact, by the time you retire, you may already have assets in your name, and you can use these as collateral to borrow money as and when you need to. Some people decide to take out loans secured against their homes. However, there is another solution for those who do not own a property or prefer not to borrow against the home – car title loans. Why Choose a Car Title Loan?So, why should seniors consider taking out a car title loan? Well, as a secured form of borrowing, these loans are more accessible to retired seniors than many other types of borrowing. In addition, it means that you can get speedy access to the cash you need, which is invaluable if you need the money for an emergency.

One of the reasons why a car title loan is a great choice is because it is a very simple application process, which is ideal for seniors who do not want to spend hours trying to work out complicated forms and processes. Everything can be done simply and easily online, which means that you can access instant online title loans without the need to leave your home at all. This means that seniors can enjoy total ease and convenience when applying for one of these loans. Another thing to bear in mind with car title loans is that they are secured against your vehicle, which means that you have a far better chance of getting one even if you have limited income and a low credit score. It can be very distressing to be turned down for finance time after time because of these things, but with a car title loan, all you need to do is own a car that is registered to you. You can then get the money you need. Something else to keep in mind is that you do not have so surrender your vehicle in order to get one of these loans, so you do not have to worry about being left without any transportation. A lot of seniors rely on their vehicles to get around and visit friends and family, get to appointments, and get out to do the shopping. Without access to a vehicle, life could become very difficult but with these loans, you can continue using your vehicle as you normally would. So, as you can see, there are many reasons why car title loans are ideal for seniors, and even those who have retired can enjoy access to this type of finance. Retirement is a time to be enjoyed. You have, more than likely, worked hard for decades and so it's a time to relax, wind down a little and enjoy life. To make this possible, it's important to put various things in place in advance. Here are 5 ways to prepare for a bright and enjoyable retirement. Pay off the MortgageRegardless of how old you are, paying off your mortgage sooner rather than later can be a huge weight off your mind. Making lump-sum capital repayments or reducing the term of your mortgage will get you once step closer to a mortgage-free life. Your monthly premiums will, of course, increase if you shorten the outstanding term, but you will save thousands in interest payments and can put the money towards your retirement fund instead. Health InsuranceWhilst Medicare will cover some of your post-retirement medical expenses, it won't cover them all, so it's worthwhile looking into Medicare supplemental plans. If you become ill or need treatment, the last thing you will want is to have to deal with hefty hospital and medical bills. An affordable monthly premium will give you peace of mind that many of these costs will be covered. There are many different plans available providing various levels of cover, so it's worth spending a bit of time looking into the options available. Diet and FitnessLooking after your body becomes even more important as you get older. With age, your bones and muscles change. Bones can shrink and become denser and weaker and muscles lose flexibility and strength, which can affect your balance and agility. A healthy diet, which should include a good level of dairy products and lots of oily fish, will help to strengthen your bones and muscles, and exercise will help to keep your body in good shape. Lower impact activities such as Yoga or Pilates are very popular and will help combat some of the aches and pains which can come with age. Time with FamilyOne of the nicest bits about retirement is having more time to spend with your loved ones. If your family doesn't live close by, you may want to consider moving closer to them, particularly if you have grandchildren. Not only will your family be able to help you out more as you get older, but they will probably be very appreciative of the free babysitting facilities that you can offer! Retirement has many positives, one of the nicest has to be watching your grandchildren grow up. Make Plans for the FutureWhilst you might not be as young as you used to be, it doesn't mean you can't plan for the future. Once you retire, you will have all the time you need to do the things that you perhaps weren't previously able to do. If there is a country you have always wanted to visit, add it to your list. If you have always fancied taking up a hobby but never felt confident enough – go for it. You need to make the most of this time, so live life to the full and have as much fun as you possibly can.

No matter your age, gender, or lifestyle, the one thing we all have in common is our desire to find a companion. As you enter your senior years, you need to remember that life doesn’t need to slow down just yet. If you’re looking for love and are tech-savvy, online dating can provide opportunities you never thought were possible. Unlike in the past where you would have to hit the bars and know a friend of a friend to find romance, online dating platforms have made it easier than ever to connect with likeminded individuals. Whether you have gone through a divorce, lost your partner, or you’re bored with being a senior single, here are 5 dating tips that can increase your chances of finding true love. Pick the Right Dating PlatformWith so many dating websites to pick from, it can be difficult to know where to start. While there is an array of choices on the internet, don’t let this put you off. To find a platform that’s suited to you, it’s advised to begin by establishing what you want. Just because you’re a senior it doesn’t mean you can’t have some fun along the way, so whether you’re after something casual or long-term, know that dating sites such as Zoosk seniors are tailored to mature singles. When picking a dating website, it’s best to check out ratings and reviews from existing users who can give you a better idea of what you can expect. Many online dating platforms offer subscriptions, so to get excellent value for money, research is key. Be Open and HonestRegardless of age, we all want to look our best when creating a dating profile. If your primary aim is to go on a date, you will need to ensure that your page stands out from the crowd. To begin, you should use current photographs that paint you in the best light. Even if you feel you looked better when you were younger, the last thing you should do is put pictures on your profile from 15 years ago! If you aren’t sure which photos to pick, enlist the help of a family member or friend who can help you select photos that are accurate and flattering. Being open and honest from the get-go will increase your chances of finding romance, so choosing pictures that represent you correctly and being truthful in your bio is important. Be Realistic with Your ExpectationsWhen signing up for a dating website, it can be all too easy to get swept up in all the gleaming profiles that catch your eye. When you first headed out on the dating scene, the internet wasn’t around, meaning you had to take people at face value and see them as they were, whereas with online dating, there are a plethora of choices, which can be both a blessing and a curse. It’s important that you are realistic with your expectations when it comes to finding a companion. While an initial attraction will naturally be at the top of your list, you need to bear in mind that you and those you are seeking to meet are at different stages in life. We can’t all be 21 forever, so bear this in mind when looking for love. Keep Baggage at BayAs a senior, it’s likely that you have been through many ups and downs throughout the course of your life. With a history of experience behind you, some things are better left unsaid until later down the line. If you have gone through a hefty divorce or you have lost your spouse, you may have negative feelings that you’re still dealing with. While It can be difficult to keep things bottled up on a first date, discussing the A-Z of your history is not recommended right away. Try and keep a positive mindset, and if you do have any baggage, make sure that you ease it into the conversation gently. Otherwise, your suitor may be hesitant to go any further. Stay SafeIf you’re about to embark on your online dating quest, or you’ve found a match and ready to meet, it’s important that you stay safe dating both online and offline. When meeting somebody new, it’s best to choose a neutral place that you’re familiar with. Make sure that you let a family member or friend know where you are, as they may be worried.

The last thing you want is to meet someone who isn’t who they say they are (otherwise known as a catfish), so being smart and savvy when online dating is crucial. Unfortunately, there are many scammers out there who are looking to con seniors out of money, so staying alert and thinking with your brain (rather than your heart) will stop you from falling into a trap. All the tips listed above can help you with your online dating journey, increasing the chances of you finding your soulmate. As the Baby Boomer generation is getting to retirement age, many are dealing with a lingering issue that makes their jobs harder. Arthritis is a common chronic pain condition for people as they get older, and it makes doing almost any task difficult if it requires using your hands. The last thing you want is to have your performance slip in the final years of your career so you face demotions or layoffs before you’re ready to retire. If you are still working and want to know how you can deal with arthritis so it does not affect your work, here are three of the best methods you will find. Pain Relief SupplementsThere are many supplements for arthritis that are specifically made to help people with arthritis. They help alleviate the pain of the condition that comes from inflammation in your affected joints. These supplements work best when combined with other means of relieving arthritis symptoms, which are explained below. Some of the best supplements for arthritis include turmeric, avocado oil, and fish oil. They have numerous health benefits, but are especially useful for people with inflammation and chronic pain. Fish oil, and other supplements with Omega-3 fatty acids, are able to relieve multiple types of inflammation, making them very helpful for people suffering with arthritis. A newer supplement that is growing in popularity is CBD, or cannabidiol. It has been shown to have very strong pain relief and anti-inflammatory properties. You can get them from any CBD retailer, or you can start your own business using Joy Organics wholesale CBD program. Prescription PainkillersExtreme cases of arthritis can be debilitating. If you have extreme pain from your condition, especially in areas like your back, it is strongly advisable to speak with your doctor. They can prescribe more powerful pain relief and/or anti-inflammatory medications to help get you through the day. For normal cases of arthritis, you can use over-the-counter medications to relieve your pain and reduce inflammation. The most common types of OTC medication are NSAIDs, such as Motrin, Aleve, and Aspirin. You can also get Tylenol or other generic OTC acetaminophen pills. These work differently from NSAIDS, as they dull your perception of pain rather than reducing bodily chemicals that cause pain and inflammation like NSAIDs. Arthritis TreatmentsAlong with supplements and medication, there are also two types of treatments that will help reduce the severity of your condition. The first is physical therapy, which helps with certain types of arthritis or in certain parts of your body. They are specific exercises that help improve the strength in your affected joints, and increase your range of motion. That can be a big help if you do repetitive motions at your job.

The other treatment is surgery, which should only be taken if recommended by your doctor. You can get joint repair, replacement, or fusion surgery. They help relieve the source of pain, reduce the sensations of pain, or make it easier to move and tolerate the pain. The best way to deal with arthritis is with a comprehensive plan that includes a mix of all three of these methods. Always consult with your doctor, who can advise you on the best supplements and medications to take for your individual health (e.g., avoiding anything that can interact badly with other prescriptions you take). They can also refer you to physical therapists and surgeons. The coronavirus pandemic has been difficult for everyone. Yet, one group of citizens that seems to be impacted by this vicious virus and the lifestyle changes the most are seniors. Due to the body’s natural aging process, people over the age of 60 are said to have weaker immune systems meaning they are at higher risk of contracting and even passing away from the coronavirus. For these reasons, senior citizens are strongly advised to remain at home where it is safest for them until a solution is developed. While remaining at home is the safest option for seniors right now, being away from your friends and family for long periods of time can lead to feelings of sadness and loneliness. You feel cut off from the rest of the world as you try and cope with the fears and anxieties you’re experiencing in the wake of the pandemic. If not addressed, these overwhelming feelings can lead to depression. If you or someone you know is having a hard time dealing with social isolation during the pandemic, here are some suggestions on how to cope. Make a Phone CallThough you can’t see those closest to you in person, there’s still the traditional form of communication. Pick up the phone and reach out to friends and family. It can make you feel good to simply hear their voice, know that they’re okay, and talk about things that either worry or interest you. Send EmailsEmails are another form of communication that can be great to use during the pandemic. As writing has always been thought of as therapeutic, emails provide you with a platform to speak out about your emotions and get support from those you love. It not only makes you feel good but can brighten up the day of recipients. You could send funny Father’s Day cards to your adult son, forward jokes to a friend, share recipes with your daughter, or send a funny video with your grandkids. Play Games With FriendsSure, you could play solitaire, complete a crossword puzzle, or do sudoku on your own, but there’s nothing like being able to play games with friends. If you start to feel isolated or lonely during the pandemic, why not invite some of your best friends to play your favorite games online? You can find gaming websites or download apps on your phone or computer and play everything from Bingo and chess to spades and poker with your friends. Attend a Watch PartySince the coronavirus pandemic started, watch parties have become an increasingly popular way to stay connected to friends and family. You can invite some of your closest friends and family to watch your favorite television show, movie, or live concert. Make some snacks, grab your favorite beverage, and curl up on the couch for a good time and entertainment. Schedule Video ChatsBetter than simply hearing the voice of your friends and family is being able to see them. It may not yet be safe enough for you to pay them a visit but video chatting is a close second. Whether you use your smartphone, laptop, or tablet, you can download free online communication tools with video features that allow you to not only talk to but see the people you reach out to. You can talk to your children, check in on the grandkids, and perhaps schedule a virtual lunch with your best friends. Join a Support GroupIf you’re really struggling with social isolation during the pandemic support from others experiencing the same thing can be a big help. Join an online support group and talk with other members about your experiences, learn about their experiences, and build connections that can last long beyond the pandemic.

No one could have ever imagined that something as serious as a pandemic would strike the country and the rest of the world the way it has. During this time it is especially important for seniors to take care of both their physical and emotional health. If you’re having an especially difficult time dealing with loneliness and isolation during the pandemic, consider the above-mentioned solutions to improve your mood and stay connected to those you care about. According to a survey conducted in 2016, there are approximately 950,000 licensed osteopathic and allopathic physicians in the United States. One-third of these physicians are 60 years or older – a few years shy of the retirement age. Whereas some physicians wait to retire and start exploring the world, others never want to give up the mental stimulation and fulfillment they get from attending to patients. A recent survey revealed that 48% of the physicians interviewed admitted that they would prefer to work on a volunteer or part-time basis upon retirement. Besides, most medical practitioners prefer to remain active as they make a living from working after officially retiring. Below are some of the jobs retired professionals who want to stay active can explore: 1. Locum tenensIf you are a doctor or medical practitioner who wants to remain active after retirement, consider working as a locum tenens doctor. The term Locum comes from a Latin phrase “to hold the place of.” Locum tenens is a good option for medical professionals who are flexible in terms of time and locations. Ever wanted to work in a rural environment in Alaska or a mining town in Nevada? Well, working as a locum tenens can give you that opportunity. All you need to do is look for a staffing or recruiting agency and give them your details. Most locum tenens jobs last from a few weeks to several months. 2. TelemedicineTechnology has made it possible for physicians to attend to the needs of patients remotely. Working as a telemedicine doctor on a part-time basis can be an excellent opportunity for retired medical professionals who want to remain engaged. There’s nothing so technical about telemedicine. All you need is a computer, smartphone, and a stable internet connection. You will be able to work in the comfort of your home and earn a good salary. Physicians working for telemedicine earn an average of $121 per hour. Besides, there are several asynchronous opportunities for telemedicine. Although most consultants pay less, the job is simple and can be done through emails or texts. 3. Job opportunities for retired nursesRetired nurses have a plethora of opportunities in terms of jobs. As a retired nurse, you can teach high school, sell medical equipment, teach first aid classes in a nursing school, or become a medical author. Retired nurses have numerous opportunities because they are knowledgeable about matters of health and nutrition. That’s the reason why they can still go back to teaching in high school or nursing schools. 4. ConsultingThe field of consulting is often mistaken as a preserve for young professionals trying to climb the corporate ladder. Nonetheless, there are many consulting opportunities for retired medical practitioners who want to continue practicing privately. Governmental, institutional, pharma, and biotech companies often need medical consultants to advise them on issues connected to products, policy, and liability. The important thing is to leverage the available opportunity 5. Healthcare AdministrationThe demand for healthcare administrators has risen in the past few years. The role of a healthcare administrator generally involves staff oversight and facility management. Administrators are the people who ensure that rules and regulations in an organization are enforced. Although the importance of medical experience is essential to succeed as a healthcare administrator, healthcare administration is different from medical practice. This means a medical professional with extra educational qualifications, such as an MBA, can excel in this particular field. 6. TeachingTeaching can also be an exciting career or volunteer opportunity for retired physicians. You might already be teaching in your residency program or medical school and would like to continue with it.

You can also decide to have a change of environment and opt to teach courses such as philosophy or anatomy at an undergraduate level. Besides, you can choose to teach physician assistant programs or nursing at any nursing school around the country. In other words, the teaching world is vast. In a nutshell, retiring is not the final call for medical practitioners. This is good, because many physicians and nurses don't like the idea of retiring and hanging the boots of medical practice. With a lot of opportunities available, you can still remain active by exploring the above possibilities. Over 70 million Americans are enjoying their senior years. Some level of cognitive decline affects many aging people. However, there are many things that can be done to slow and even prevent damage to important brain functions. Seniors that take a proactive stance on their own aging can expect to reduce the symptoms of cognitive decline. Through healthy living, including a balanced diet and exercise, seniors can improve their chances of maintaining a healthy brain well into their retirement years. Your brain needs fuel to maintain cell regeneration and circulation in the same way as the rest of the systems in your body. Adding quality supplements like the blends from Plant Therapy can help you to provide your brain with the nutrients that it needs to stay healthy and at its top performance. Let’s take a look at the top 5 supplements for senior cognitive function support. Vitamin B1Vitamin B1, also known as Thiamine can be lacking in seniors that aren’t getting the right nutrients in their diet. A Thiamine deficiency can be connected to brain issues like Alzheimer’s, dementia and Korsakoff Syndrome. You can get the B1 nutrients that you need from most high-quality multivitamins that are specifically designed for seniors. If you need to increase your levels, talk to your doctor about adding a Thiamine supplement to your regular diet. MagnesiumMagnesium plays an important role in breaking down your dietary nutrients and getting them to the areas of your body where they are needed. A lack of magnesium in your diet can lead to a lack of circulation. When your brain isn’t getting the right amount of nutrient-rich blood, it can lead to personality changes including memory loss and confusion. A regular magnesium supplement can help you to increase your memory and cognitive function by improving the breakdown of vital dietary nutrients. Vitamin EFree radical cells in the brain that are left unchecked can contribute to the breakdown of cognitive function. Vitamin E contains important antioxidants that search for and destroy these free radical cells across your body, including your brain. Regular Vitamin E supplements with a minimum dose of 15mg that are taken daily have shown to help improve overall brain health and fight the early signs of dementia. CalciumMany seniors, especially women, already take a Calcium supplement to help keep their bones strong and fight off issues like Osteoporosis. However, if you are not getting enough Calcium in your regular diet then you may be missing out on many of the powerful brain benefits. Calcium has been shown to regulate healthy cell regeneration in the brain. Calcium supplements should be taken with food so that the nutrients can be properly broken down in the digestive tract for the most benefit to your brain function. ZincSeniors that want to increase their daily Zinc intake should be adding a daily supplement of at least 40mg. Eating a healthy diet that includes dairy, nuts and shellfish. If you aren’t getting enough zinc in your diet it can affect the efficiency of the neurotransmitters in your brain. This can lead to a breakdown in cognitive function.

Getting older comes with many pitfalls and areas of physical decline. To keep your brain in the best health it’s important to make sure that you are getting the right nutrients and adopting a healthier lifestyle to help you get the most out of your golden years. Many people these days have heard about CBD products, and although they may not have tried these products themselves, they often know someone who has. This is because the popularity of CBD is on the rise, with a range of factors helping to make them more accessible and more popular. This includes changes in legislation, great press reports, and a wider choice of products to suit a variety of needs and preferences. From CBD gel capsules to CBD drops and tinctures, edibles, skin products, and bath additives, there are many products you can choose from these days. Many of these are also ideal for seniors and can offer a host of benefits that many people are unaware of. There are all sorts of issues that seniors may experience, and these can have a profound negative impact on life quality. In this article, we will look at some of the ways in which CBD can benefit seniors. What Are the Benefits for Older Users?CBD can provide a host of benefits for older users, and this is why many seniors have started to use these products. Some of the key benefits you can look forward to as a senior include: Enjoying Sounder SleepMany people find it more and more difficult to get to sleep as they get older. When you retire, you may find that the sudden change from working all day to having a lot of free time makes it more difficult to get into a routine with sleep. Well, CBD is able to boost serotonin levels, and this helps to regulate sleep patterns. So, by using CBD products, you can enjoy a far better night’s sleep. This will then have a positive impact on your health and wellbeing. Dealing with Pain and InflammationAnother problem that many older people experience is pain and inflammation. Many seniors develop health conditions that can lead to inflammation and pain, and some may sustain injuries that leave them in pain and discomfort. The good news is that CBD has proven itself as an excellent painkiller as well as a very effective anti-inflammatory. So, it provides a simple and very effective solution when it comes to easing pain and inflammation for seniors. Boosting Energy LevelsAs we get older, we often struggle when it comes to energy levels. Being less energetic comes with getting older, but some seniors really struggle to feel energized. When you use CBD products, you can look forward to a boost in energy levels. Taking CBD in small doses during the day can help to boost your energy and keep energy levels up, so you can get on with enjoying your day. Improving Life QualityBy providing you with benefits such as those listed above, CBD products can help to boost overall life quality for seniors. There are many different types of products to choose from too, which means that older users can find the ideal one to suit their needs and preferences.

|

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed