|

Want to save more cash for retirement but not sure how to get started with an effective strategy? You are not alone, because most working adults feel the same way. Recent economic downturns like soaring inflation and housing market disruptions have made it more challenging than ever to sock away money for the long haul. Is there a solution? Luckily, there are a few tactics that can increase a person's chances of initiating and slowly increasing the balance of a designated retirement account. The following suggestions can help you get priorities in order and begin saving as quickly as possible. Know Your OptionsFind out what kind of benefits are available to you by asking your employer about 401(k) plans, matching provisions for payroll savings accounts, and any other company-sponsored options. Many private companies still offer generous matched savings plans that are essentially free money for workers who have the discipline to set aside a percentage of their incomes. Adjust the Monthly BudgetThere is one simple math equation: when you reduce monthly expenses, there's more left over for other purposes, including IRAs and similar arrangements for your golden years. Of course, the trick is to figure out how to get those expenses down. For those who are carrying a balance on one or more education loans, there is plenty of potential. That's because a student loan consolidation can be an excellent, simple, and effective way to combine all the loans into a single monthly payment with potentially better terms, rates, and repayment timing. It's important to learn the ins and outs of how consolidating works by reviewing an informative guide that uses clear examples to delineate the benefits of the process. Speak with a ProfessionalSpending money to pay for an hour session with a licensed retirement planner is a wise investment for most working adults. Unless you know the landscape well, take the time and make the investment to get solid, reliable advice that is based on your specific financial situation. Unfortunately, too many adults assume that paying an expert for financial advice is a waste of money. But if you find a competent service provider with experience in the field. Check Your Earnings RecordCreate an account with the SSA (Social Security Administration) in order to access your lifetime earnings record. Another advantage of having an account is that you can use the online SSA tools to see how much you need to earn between now and retirement to achieve specific monthly benefit amounts. In about 20 minutes, users can see exactly how much they have already paid into the system and choose an optimal date for beginning to receive benefits. Downsize Wherever PossibleThere is a lot to think about at this stage and the considerations of downsizing your home and lifestyle are no exception. Make an honest personal assessment about where you can downsize. Is it possible to sell your home and purchase a smaller one, move into a townhouse, or buy an efficient condo? Do your own more vehicles than you need? What about all that stuff stored away in the attic, basement, and garage? Can you sell some or all of it for a quick cash boost? Downsize wherever you can in order to free up monthly cash flow for long-term savings.

0 Comments

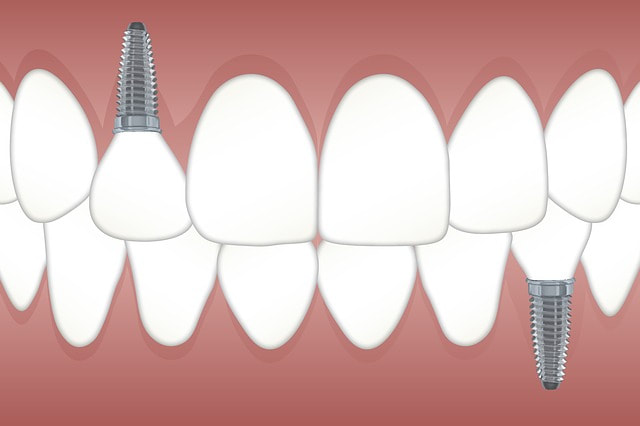

Insurance is an important facet of day-to-day living in the modern world, especially when you’re over the age of 60. That’s because, as you progress into retirement age, your bodily functions start to wane, which can open you up to a lot of situations whereby you may need insurance to protect yourself financially. With that said, here are 5 important types of insurance to consider when you retire; Travel InsuranceWith a free schedule and little to do in your retirement years, taking vacations, exploring landmarks in places you've always wanted to visit, or just enjoying the ambiance of a country is not a bad idea. But with everything comes its risks, and investing in travel insurance would go a long way in making a trip risk-free. Travel insurance suits fun-seekers or vacationers who just want to relax. Most policies cover inconveniences like flight or hotel cancellation, lost or stolen luggage, and even slight medical issues that might require a hospital visit during the trip. It’s important to avoid a senior insurance scam when trying to get travel insurance - that’s because seniors tend to be targets of scam attacks by fraudsters looking to take advantage of your desire to seek out insurance. Dental InsuranceDental insurance policies for retirees help in budgeting the maintenance of oral care. The policy can come as a standalone or included in a medical plan. This covers issues relating to the teeth, gum, and also preventive measures. Most insurance companies adopt the 100/80/50 payment structure which states the company covers 100% for preventive measures like cleaning the teeth and X-rays, 80% for basic procedures that include treating gum diseases or getting fillings; and 50% for major procedures like surgeries, inlays, and dentures. A great place to seek out dental insurance coverage is dentalinsurance.com. They’re a service that displays various dental insurance plans while also allowing you to compare and choose the one that fits your budget. Lifetime AnnuitiesA lifetime annuity is an income based plan for retirees. It gives the security of a steady allowance each month until they pass away. Unlike other retirement plans such as an IRA or a 401k which are heavily dependent on the state of the economy - lifetime annuities can offer retirees guaranteed income regardless of any economic downturns or stock market crashes. Lifetime annuities vary differently from life insurance in the payment aspect, in the sense that life insurance payment is paid out after the demise of its holder, while lifetime annuities are paid out in perpetuity while its holder is alive. Vision InsuranceVision Insurance for retirees is usually attached to health insurance, but can also be a standalone plan. It’s designed to handle the costs of eye checkups, prescribed eyeglasses, and contact lenses for its policyholders. The care providers give ranges from discounts on lenses or frames to covering partly for any laser eye surgery. With the insured only able to use the approved care by the provider. Health InsuranceHealth insurance is a contract issued by an insurance company that pays for the medical bills, surgeries, and drugs on behalf of its policyholder.

Acquiring health insurance is a relatively straightforward process, however, some issues can arise while selecting a plan to run with. For instance, most of the plans come with rules that may act as a barrier for getting another healthcare in the future. Some of these include being unable to use another service aside from the designated one by the provider and refusing to honor service payments when the service is obtained without proper approval. Most health insurance plans typically have a program especially made for retirees. While others not offered can be gotten through programs, qualifications, or direct purchase through the healthcare insurance marketplace. Teaching English abroad can be a life-changing opportunity. There are multiple reasons why people teach English abroad. One of the main reasons people want to teach English abroad is because it gives you the opportunity to travel the world without going broke.

Before you can start, you’ll have to get the necessary certifications. A lot of countries don’t require a teaching or English degree, but a valid TEFL (Teaching English as a Foreign Language) certification is a minimum requirement before you can start your adventure abroad. While a TEFL certification isn’t as expensive as a teaching or English degree, it does cost some money. If you are interested in getting your TEFL certification but don’t have the money right now, here are some excellent ways to earn or save money so you can enroll in that life changing course. 1. Make a budget and stick to it Everything starts with a budget. To get a good understanding of your own finances, it is important to track everything. Write down what you earn each month and write down what your expenses are each month. The goal is to make the difference between income and expenses as high as possible, in the positive direction that is, so that you can save as much as possible. By creating a budget for yourself, you can keep your expenses in check. Do you have an expensive coffee habit? By allocating a certain part of your budget to coffee runs, you get a better understanding of how much money actually goes into those daily lattes. 2. Save on the not important things Saving money usually means cutting back on something. That doesn’t mean you have to cut back on everything. Successfully saving money is a marathon, which means you’ll have to create a sustainable routine. Don’t eliminate the things you love dearly - if that daily latte is really important for you to start your day, keep it or try to be creative and make your own latte at home. But is that cookie you always get with your morning latte really that important or more of an indulgence? Identify the things that you can eliminate or cut down on and focus on those first. Once you see how much money you can see, it might inspire you to tackle some of your persistent habits too. Need some more inspiration? Check this article for more money-saving life hacks. 3. Get rid of unwanted items So you want to teach English online and travel the world, but you need extra money to enroll in the necessary courses? This is the perfect moment to take a good look at your home and your closet for unwanted items. You’ll be traveling soon anyway and you can’t take all your belongings with you, so why not sell some things off to earn a little extra cash? A great way of getting rid of some unwanted items is by selling them at a flea market. 4. Get a second job One of the easiest ways to increase your income is by getting a temporary second job. Seasonal jobs are perfect for this. Some examples of seasonal jobs are summer camp positions, tour guides, seasonal retail jobs or summer festival jobs. If you’re looking for something a little more steady, try a weekend or evening job. Restaurants are always looking for people willing to work evenings or weekends. 5. Become a tutor A great way to practice becoming a teacher and earning some extra money in the process is by tutoring. Whether you are still a student yourself, a teacher, or somebody who recently graduated, as long as you are able to break down difficult material to an understandable level, you’ll have no trouble finding students to tutor. 6. Get creative Do you have a knack for painting or knitting? Or what about making jewelry or designing T-shirts? There are hundreds of opportunities to sell your creations online and make a little money on the side. Etsy is probably the most well-known website for selling your DIY creations, but there is also Shopify, Amazon Handmade, Ebay, or your own personal website. 7. Become a blogger As you prepare to teach English abroad, you’ll probably have some interesting stories to tell. People love hearing from other people who are trying new things, especially if the thing they are trying to do is exotic and a little out of the box. Traveling the world and teaching English abroad is one of those things. Keeping a blog as a way of documenting your journey could very well turn into an extra source of income. For example, you can earn money with ads or affiliate marketing. 8. Freelance as a side hustle Are you good at your job? Then why not freelance in your own time to increase your income? There are so many job opportunities for freelancers, as long as you know where to look. You can attach yourself to an agency or work on freelancer platforms such as Upwork or Fiverr. Some typical freelancer jobs are writing and editing, web development, or graphic design, but you can also freelance in accounting, data entry or by becoming a virtual assistant. Conclusion Teaching English abroad can be a life-changing opportunity for you, but first you need to get the necessary certifications. While a TEFL certification isn’t as expensive as a teaching or English degree, it is not free either. Luckily there are more than enough ways for you to save money or increase your income. It all starts with creating a budget and sticking to it. Next, identify your costly habits and try to change them. Now that you’re thinking about traveling the world as an English teacher, why not purge your home and closet of unwanted items and sell them? Now that you’ve got your spending habits under control, it is time to increase your income. Look for a second job, become a tutor, sell your DIY creations online, become a blogger and share your adventures with the internet or freelance as a side hustle. Another aftershock of the COVID-19 pandemic has been the closure of personal lines of credit. Banks like Wells Fargo have been closing lines of credit and reducing credit card limits. These have been involuntary and disruptive changes for customers. However, the economic woes and regulatory changes have prompted big banks to reduce risk and protect their bottom lines. As a result, customers face several consequences, including negative impacts on their credit scores. In addition, they no longer have access to some accounts. Why Are Many Banks Closing Lines of Credit?Some banks are closing personal lines of credit and removing these products altogether. For example, Wells Fargo said it retreated from these products because of the pandemic and Federal Reserve limitations. The bank was previously involved in a scandal where employees opened fake accounts for customers without their knowledge. The customers did not give the authorization. As a result, the Federal Reserve put limitations on Wells Fargo's growth. Those limitations include growth restrictions until the bank corrects its compliance deficiencies. Consequently, Wells Fargo has had to offload assets and deposits and cut products. Personal lines of credit were on the chopping block. The bank states that instead, it will focus on credit cards and personal loans. However, some customers used the revolving credit lines as overdraft protection to fund home improvements and cover emergency expenses. Now they must look for alternatives. For more information on alternatives, Simple Fast Loans has a list of FAQ’s on lines of credit, personal loans and the loan process in general. Credit Cards and Reduced Credit LimitsBeyond the Wells Fargo scandal and ensuing growth limitations, other banks are closing credit cards and reducing card limits. This has been occurring for younger generations more so than older ones. Approximately 56% of younger millennials have had their credit limits reduced. About 44% of this age group have had credit card accounts closed involuntarily during the pandemic. This is compared to Generation X, whose numbers have been 33% for limit reductions and 21% for involuntary account closures. Only 8% of Baby Boomers reported a credit limit reduction, and 3% indicated a card was closed without their consent. These banks can no longer take as many liberties with extending credit. Accounts are more likely to be closed if they see little use. Extended periods of not using cards can lead to closures and limit reductions. Why Does an Absence of Activity Trigger Limits and Closures?When you don't use your card as much or at all, the bank sees this as a signal that you don't need or want the credit. Just like a person tightens their belt by cutting things they don't need a bank will reduce its financial risk by doing the same. If you're not using as much credit as you have or any at all, the bank sees the open account as an unnecessary liability. Creditors can improve their bottom lines and balance sheets by reducing their potential liabilities. Unfortunately, once this decision is made, the customer has little recourse. In other words, you're unlikely to get the creditor to reopen your account or bump your limit back up. You have to seek another bank or creditor willing to let you open an account. Your other alternative is to look for other financial products or ones that can serve the same purpose. For example, say you want overdraft protection for your checking account. But your bank closes the line of credit that serves as protection. Change to a bank that doesn't charge overdraft fees. Customer ImpactsBesides losing access to a personal line of credit, customers must deal with other negative impacts. The most serious one hits their credit scores. Having accounts closed and limits reduced both impact a person's credit score. That's because these actions reduce a person's revolving credit. Having less available credit means it's more likely your utilization rate will go up. Your utilization rate is how much credit you're using compared to how much you have available. The higher your utilization rate, the lower your credit score can be. Even though your rate of use is only one of the things that go into your score, a higher rate means you're a bigger risk. But when accounts are closed or limited further through no fault of your own, you suddenly become a higher risk. You probably haven't changed your habits, like being a good borrower and using credit wisely. Alternatives Customers Can SeekThose impacted by credit limit reductions and account closures can turn to alternative financial products. For example, checking account overdrafts can sometimes be covered by a linked savings account. Check with your bank to see if this is an option and do it. Then, maintain enough balance to cover any overdrafts and waive overdraft fees. You can also switch your checking account to a bank that doesn't charge overdraft fees (even without a linked backup). Credit cards may be an excellent way to pay for emergencies and unexpected purchases. However, personal loans are another way to go. Some creditors have revolving personal loan options you can borrow against when you need to. Others are one-time deals. So, you can borrow what you need for an emergency, a home repair or renovation, or to cover an expense you'd rather pay in increments over time. Revolving personal loans are a way to boost your credit score with on-time payments and proper use. Final ThoughtsWondering why many banks are closing lines of credit? Most are concerned with growth limitations imposed by federal regulations and the need to reduce risk. In addition, the pandemic has ushered in economic uncertainty and financial losses for businesses.

Banks and creditors usually look to reduce risk during times like these. Getting rid of overlapping or duplicate products is one way. Another is to look at customers that aren't using available credit and reduce or cut it off. Though you may be hesitant to commit to a new pet during your retirement years due to physical limitations, adopting can be a significant boost in your everyday life. Though it may take a few weeks to settle into your new life as a pet parent, adopting a furry friend can enrich your life so profoundly that it’s worth addressing potential issues down the road. If you’re looking for companionship in your latter years, consider the benefits of adopting a new pet as you head into retirement. ExerciseWhether you opt for a cat or kitten, an adult dog, or an energetic puppy like these, a new pet is a great way to get your body moving. Dogs need walks, of course, but all pets need playtime throughout the day to stay happy and healthy. Ultimately, you can stay active while giving your furry friend the mental and physical stimulation it needs to thrive. CompanionshipUnfortunately, retirement can be a lonely time for many elders— this is especially true if you tend to stay home most of the time or are grieving the loss of a loved one. Thankfully, pets are excellent companions through good times and bad. Their love is unconditional, making them the perfect antidote for loneliness. CommunityPet owners are less socially isolated even beyond their animal’s companionship. Owning a pet provides you with common ground to share with others, creating a built-in conversation topic with any neighbors you see out and about while walking your furry friend. Additionally, don’t underestimate the social connections your dog or cat could help you forge online. Between joining internet forums about pet parenthood and sharing pictures on social media, there’s always something new to talk about with a pet. Health benefitsRetirees benefit physically from owning a pet, too. A 2017 study found that regularly walking your dog can stretch joints and keep muscles strong well into your retirement years, leaving you with fewer visits to the doctor for daily pains. RoutineRetirement can bring many positive changes, but losing an everyday routine may come as a challenge to fresh-faced retirees. Fortunately, a new pet can help tremendously with reestablishing a sense of rhythm in your day-to-day activities. Pets need consistent care and attention to thrive, so creating a routine around your new furry friend can keep you both on a regular schedule. Help a senior petPlenty of dogs and cats require adoption, and senior pets are even less likely to be adopted, and opting to make the last few years of a pet’s life as pleasant as possible can be enriching. Who knows—the perfect dog breed for you might end up being the mutt at a nearby animal shelter. You could spare yourself the extensive puppy training period and gain a fulfilling purpose at the same time by choosing to adopt an adult dog. A final wordThough a new pet is a commitment, you shouldn’t rush into, adopting a little friend can significantly improve your everyday life.

|

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed